Payback period calculator

Investing your money wisely is crucial for financial success, but how do you know if an investment is worth it? One key metric to consider is the payback period – the time it takes to recover your initial investment from the cash inflows the investment generates.

Our Payback Period Calculator makes it easy to estimate this timeframe with just two inputs: your initial investment and the annual cash inflow.

What Is the Payback Period?

The payback period helps you assess the risk and liquidity of an investment. A shorter payback period means you recover your money faster, reducing risk and freeing up funds for other opportunities.

However, it’s important to consider not just how quickly you get your money back but also the overall profitability and long-term benefits of the investment.

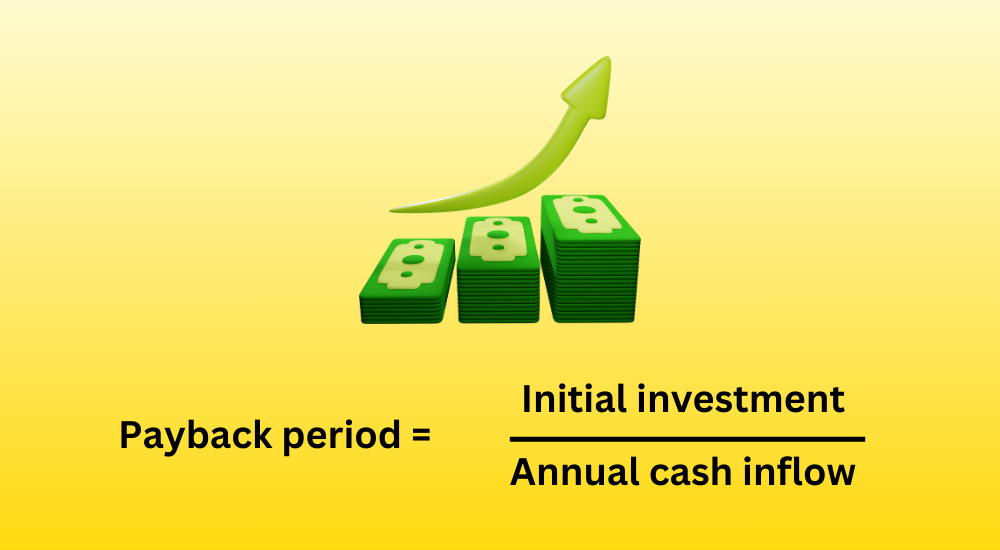

The formula for calculating the payback period

When your annual cash inflow is consistent, calculating the payback period is straightforward:

Payback Period = Initial Investment / Annual Cash Inflow

- Initial Investment: The amount of money you’re putting into the investment upfront.

- Annual Cash Inflow: The amount of money the investment brings in each year.

Practical Examples

Let’s explore two examples to see how this calculation works in real-life scenarios.

Example 1: Opening a Coffee Shop

Suppose you’re planning to open a small coffee shop, which requires an initial investment of $80,000. You expect the shop to generate an annual cash inflow of $20,000 after expenses.

Using the formula:

Payback Period = $80,000 / $20,000 = 4 years

Explanation: It will take you 4 years to recover your initial investment from the profits of the coffee shop.

Example 2: Purchasing Manufacturing Equipment

Imagine your company needs new machinery costing $150,000, and this equipment is expected to save you $50,000 annually through increased efficiency.

Using the formula:

Payback Period = $150,000 / $50,000 = 3 years

Explanation: The investment in new equipment will pay for itself in 3 years through cost savings.

What to Consider Before Investing

While the payback period is a useful metric, it’s not the only factor to consider:

- Time value of money: The payback period doesn’t account for the fact that money today is worth more than the same amount in the future due to its earning potential.

- Cash flow after payback: It ignores any benefits or cash inflows that occur after the payback period, potentially overlooking long-term profitability.

- Risk assessment: A shorter payback period typically means less risk, but also consider the stability of cash inflows and market conditions.

- Alternative investments: Compare the payback period of different investments to determine which offers the best return relative to the time frame.

- Total return on investment: Look beyond the payback period to consider the overall ROI, including net present value (NPV) and internal rate of return (IRR).

Investments with Shortest Payback Periods

Certain types of investments generally offer quicker returns:

- Technology upgrades: Investing in software or equipment that improves efficiency can lead to immediate cost savings.

- Energy efficiency projects: Installing energy-efficient systems reduces utility bills, leading to faster recovery of investment costs.

- High-Demand products or services: Launching products with immediate market demand can generate quick sales and revenue.

- Short-Term loans: Providing short-term financing at favorable interest rates can result in quick repayment and interest income.

- Franchise opportunities: Some franchises have established customer bases and business models that allow for faster profitability.

Conclusion

Calculating the payback period is a valuable step in evaluating whether an investment is right for you. It provides a clear picture of how long it will take to recover your initial outlay, helping you assess risk and make informed decisions. However, remember to consider other financial metrics and factors to get a comprehensive view of the investment’s potential.

Use our Payback Period Calculator to input your initial investment and expected annual cash inflow. With this tool, you can quickly determine the estimated time frame to recoup your investment and plan your financial future more effectively.

By understanding the payback period and considering all aspects of an investment, you can make choices that align with your financial goals and risk tolerance.

Good luck with your investments!

Related topic: Savings goal calculator