Mortgage calculator

Monthly Payments:

Understanding Your Mortgage Payments with Our Mortgage Calculator

Taking out a mortgage is one of the biggest financial commitments you’ll make, whether you’re buying your first home, refinancing, or investing in real estate. But how do you know what your monthly payment will be? That’s where our Mortgage Calculator comes in handy.

By entering your loan amount, interest rate, and loan term (in years), the calculator will tell you exactly how much you need to pay each month. In this post, we’ll explain the formula behind it, walk you through a couple of examples, and explore why it’s useful to understand your mortgage payments.

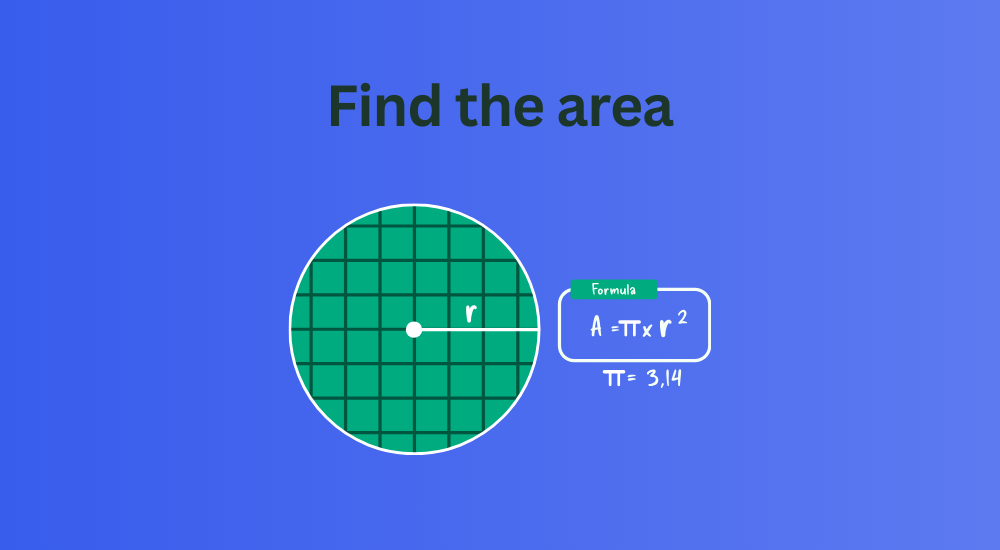

The Formula for Mortgage Payments

The formula to calculate your monthly mortgage payment is:

M= P * ( r(1+r)^n) / ((1+r)^n − 1)

Where:

- M is the monthly mortgage payment.

- P is the loan amount (principal).

- r is the monthly interest rate, which you calculate by dividing the annual interest rate by 12.

- n is the total number of payments (loan term in years multiplied by 12).

This formula takes into account the loan amount, the interest rate, and the length of the loan, giving you a clear picture of how much you’ll need to budget each month.

Practical Example

Let’s walk through a couple of real-life examples to make the formula clearer.

Example: A 30-Year Mortgage

Imagine you are taking out a $300,000 mortgage with an annual interest rate of 4% for a 30-year term.

- First, calculate the monthly interest rate by dividing the annual rate by 12:

r = 4%/12 = 0.00333

2. Then, calculate the total number of payments:

n = 30 × 12 = 360

Using the formula:

M = 300,000 * (0.00333(1+0.00333)^360) / ((1+0.00333)^360−1) ≈ 1,432.25

In this case, your monthly mortgage payment would be $1,432.25.

Why It’s Nice to Know Your Monthly Payments

Understanding your monthly mortgage payment is crucial for good financial planning. It allows you to know exactly how much you need to set aside each month for your mortgage, which helps you create a budget that works for your lifestyle.

By knowing your monthly payments ahead of time, you can determine whether a loan is affordable for you or if you need to adjust the loan amount or term to fit within your budget.

Knowing your mortgage payment also helps with future planning. For example, if you’re considering making extra payments or paying off your loan early, you can use the mortgage calculator to see how much interest you’ll save and how much faster you can pay off the loan.

Real-Life Examples of Where This Information is Useful

- Buying a Home: Before you even start shopping for a house, you should know what price range fits your budget. By inputting various loan amounts, interest rates, and terms, you can see what your monthly payment would be and find the right loan for your financial situation.

- Refinancing a Mortgage: If you already have a mortgage but want to lower your interest rate or shorten your loan term, a mortgage calculator helps you see what your new monthly payment would be. This allows you to decide if refinancing is the right move for you.

- Planning for Future Expenses: If you’re thinking about future expenses like saving for college, retirement, or vacations, knowing your exact mortgage payment helps you plan. It shows you how much extra cash you have left over after making your mortgage payment each month, so you can allocate funds toward other financial goals.

Conclusion

Knowing your monthly mortgage payment isn’t just about understanding your loan—it’s about preparing for the future. By using our Mortgage Calculator, you can easily figure out how much your loan will cost you each month, making it easier to plan, budget, and reach your financial goals.

Whether you’re buying a home, refinancing, or just planning ahead, knowing your mortgage payment is a vital part of managing your finances wisely.

Related article: Prism Surface Area Calculator