Investment Return Calculator

Investing can be one of the most effective ways to grow your wealth over time. But knowing exactly how much your investment will grow can feel a bit daunting.

That’s where our Investment Return Calculator comes in! With just three easy inputs – your initial investment, the annual rate of return, and the time frame in years, you can see how much your money could grow over time.

Let’s dive into how this works and why starting early is so important.

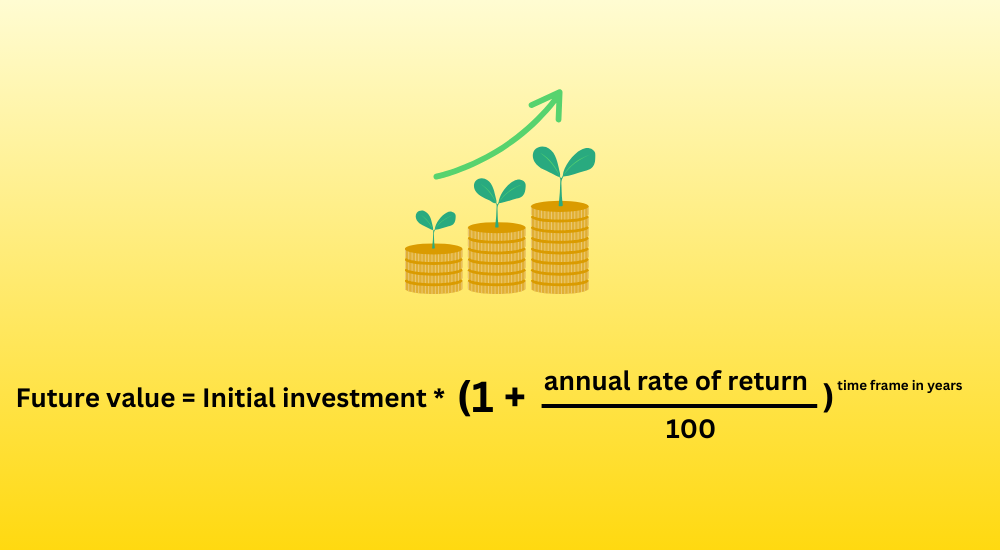

The formula for calculating investment return

Our calculator uses the formula for calculating the future value of a lump sum investment with compounded interest. Here’s the formula:

- Initial Investment: The amount of money you start with.

- Annual Rate of Return (%): The expected annual growth rate of your investment.

- Time Frame (Years): The number of years you plan to keep the investment.

This formula assumes that your investment grows at a constant rate each year and that all returns are reinvested, meaning the interest you earn also earns interest. This is the magic of compounded interest!

Practical examples

Let’s walk through two practical examples to see how this formula works:

- Example 1: Saving for a college fund

Imagine you invest $5,000 with an expected annual rate of return of 6% for 15 years. Using our formula, you can calculate the future value of your investment:

Future Value = 5000 × (1 + (6/100))^15

This simplifies to:

Future Value = 5000 × (1 + 0.06)^15

Future Value = 5000×(1.06)^15

Future Value ≈ 5000 × 2.3966 = 11,983

After 15 years, your initial investment of $5,000 would grow to approximately $11,983. That’s more than double the amount you started with, thanks to the power of compounding!

- Example 2: Planning for Retirement

Suppose you invest $10,000 with an annual rate of return of 8% over 30 years. Plugging these numbers into the formula gives us:

Future Value = 10000 × (1 + (8/100))^30

This simplifies to:

Future Value = 10000 × (1 + 0.08)^30

Future Value = 10000 × (1.08)^30

Future Value ≈ 10000 × 10.0627 = 100,627

After 30 years, your $10,000 would grow to around $100,627. That’s ten times your initial investment, illustrating the huge impact of compounding over a long period.

The benefits of investing early

The earlier you start investing, the more time your money has to grow. This is due to the principle of compounded interest, where you earn interest not just on your initial investment, but also on the interest that accumulates over time.

It’s like a snowball rolling down a hill – the longer it rolls, the bigger it gets!

Starting early allows you to take full advantage of compounding, which can significantly boost your returns over time.

For example, investing $5,000 at an 8% return for 40 years results in a much larger amount than investing the same amount for 20 years, even though the difference is only 20 years. The key takeaway is: the sooner you start, the more time your investment has to grow.

Conclusion

Investing doesn’t have to be complicated. With our Investment Return Calculator, you can quickly see how your money can grow over time and make informed decisions about your financial future.

Remember, the key to maximizing your returns is to start early and stay consistent. Use our calculator to map out your investment journey and watch your money grow!

Related calculator: Payback period calculator